I’m a passionate writer who loves exploring ideas, sharing stories, and connecting with readers through meaningful content.I’m dedicated to sharing insights and stories that make readers think, feel, and discover something new.

India's Fintech Landscape

India's fintech sector has been rapidly evolving, with significant advancements in digital payments, lending, and financial inclusion. However, the recent fintech jamboree in India made headlines for what it left out rather than what it included: cryptocurrencies and stablecoins.

Focus on Traditional Financial Technologies

The event, which gathered industry leaders and policymakers, focused on enhancing traditional financial technologies. Discussions centered around improving digital payment systems, expanding financial services to underserved regions, and leveraging technology to boost economic growth.

Despite the global buzz around cryptocurrencies, India has maintained a cautious stance. The Reserve Bank of India (RBI) has repeatedly expressed concerns about the potential risks associated with digital currencies, including volatility and security issues.

Why Crypto Was Left Out

India's decision to exclude cryptocurrencies from the fintech event aligns with its regulatory approach. The government has been working on a comprehensive framework to regulate digital currencies, but until then, the focus remains on more established financial technologies.

Stablecoins, which are pegged to traditional currencies, were also absent from the discussions. This exclusion highlights India's preference for maintaining control over its monetary policy and financial systems.

The Future of Fintech in India

While cryptocurrencies were not part of the recent fintech discussions, India's fintech sector continues to thrive. The country is home to several unicorns and startups that are innovating in areas like digital lending, insurance, and wealth management.

Experts believe that once a regulatory framework is in place, cryptocurrencies could play a role in India's fintech ecosystem. However, for now, the focus remains on strengthening existing financial technologies and expanding access to financial services.

Global Implications

India's cautious approach to cryptocurrencies could influence other countries with similar concerns. As one of the world's largest economies, India's fintech policies are closely watched by global markets.

For now, the fintech jamboree serves as a reminder of India's priorities: enhancing financial inclusion and leveraging technology to drive economic growth, without the immediate inclusion of cryptocurrencies.

Further Reading

Related articles in this category

World News

El Mencho Killed: The Fall of Mexico's Most Powerful Drug Cartel

February 23, 2026

The recent killing of Nemesio Rubén Oseguera Cervantes, known as 'El Mencho', has led to significant upheaval in Mexico as the Jalisco New Generation Cartel faces a power vacuum. This article explores the implications of his death on the drug trade and national security.

World News

Sam Altman vs. Sridhar Vembu: A Clash on AI and Human Energy Consumption

February 22, 2026

In a recent discussion, Sam Altman compared the energy consumption of AI systems to that of humans, prompting a strong rebuttal from Sridhar Vembu. This article explores their contrasting views on energy efficiency and sustainability.

World News

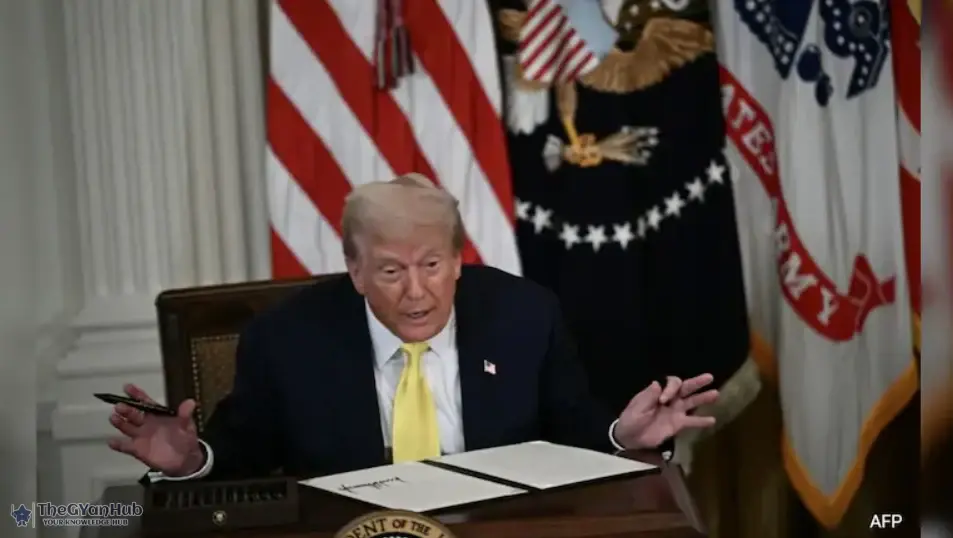

Trump's Loss, India's Gain? How Tariff Order Could Affect Trade Talks

February 20, 2026

The US Supreme Court's decision to strike down Trump's Global Tariffs Policy may have significant implications for India, potentially reshaping trade dynamics. As New Delhi navigates this change, the global trade landscape could see a shift in power.

Indiafintechcryptocurrencystablecoinsdigital paymentsfinancial technologyRBIregulationeconomic growthfinancial inclusion