I’m a passionate writer who loves exploring ideas, sharing stories, and connecting with readers through meaningful content.I’m dedicated to sharing insights and stories that make readers think, feel, and discover something new.

Introduction

Kaynes Technology India Limited has recently caught the attention of investors with its significant market breakout. As traders and investors eagerly watch the stock's performance, the question remains: will this breakout sustain through next week? In this article, we delve into expert risk mitigation techniques and offer free trading signals to help you sharpen your trading edge.

Understanding the Breakout

The recent breakout in Kaynes Technology India Limited's stock has been driven by a combination of strong financial performance and positive market sentiment. Investors are optimistic about the company's future prospects, which has led to increased buying pressure. However, it's crucial to analyze whether this upward trend is sustainable or merely a temporary spike.

Factors Influencing the Breakout

Strong quarterly earnings report

Positive industry trends

Increased investor interest

These factors have contributed to the stock's recent performance, but it's essential to consider potential risks that could impact its trajectory.

Risk Mitigation Techniques

To navigate the volatile nature of stock markets, investors should employ effective risk mitigation strategies. Here are some techniques to consider:

Diversification

Diversifying your investment portfolio can help reduce risk. By spreading investments across various sectors and asset classes, you can minimize the impact of a downturn in any single investment.

Setting Stop-Loss Orders

Implementing stop-loss orders can protect your investments from significant losses. By setting a predetermined price at which your stock will be sold, you can limit potential losses if the market moves against you.

Regular Portfolio Review

Regularly reviewing your portfolio allows you to assess the performance of your investments and make necessary adjustments. This proactive approach helps in aligning your investments with your financial goals and risk tolerance.

Free Trading Signals

To enhance your trading strategy, consider utilizing free trading signals. These signals provide insights into potential market movements, helping you make informed decisions. Several platforms offer free trading signals, which can be a valuable resource for both novice and experienced traders.

While trading signals can be beneficial, it's important to use them in conjunction with your analysis and not rely solely on them for making trading decisions.

Conclusion

As Kaynes Technology India Limited continues to capture the interest of investors, it's crucial to stay informed and employ effective risk mitigation strategies. By understanding the factors driving the breakout and utilizing free trading signals, you can enhance your trading approach and make more informed investment decisions.

Further Reading

Related articles in this category

El Mencho Killed: The Fall of Mexico's Most Powerful Drug Cartel

February 23, 2026

The recent killing of Nemesio Rubén Oseguera Cervantes, known as 'El Mencho', has led to significant upheaval in Mexico as the Jalisco New Generation Cartel faces a power vacuum. This article explores the implications of his death on the drug trade and national security.

Sam Altman vs. Sridhar Vembu: A Clash on AI and Human Energy Consumption

February 22, 2026

In a recent discussion, Sam Altman compared the energy consumption of AI systems to that of humans, prompting a strong rebuttal from Sridhar Vembu. This article explores their contrasting views on energy efficiency and sustainability.

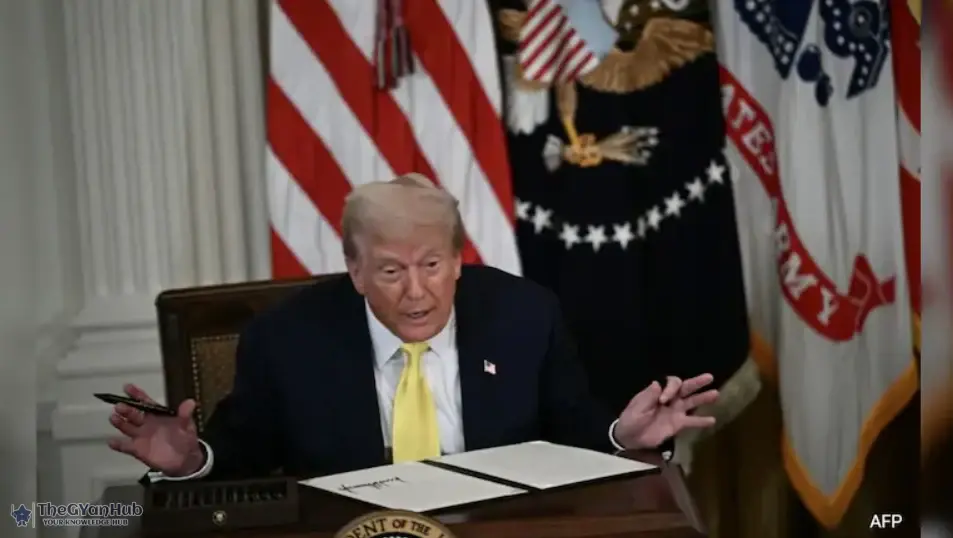

Trump's Loss, India's Gain? How Tariff Order Could Affect Trade Talks

February 20, 2026

The US Supreme Court's decision to strike down Trump's Global Tariffs Policy may have significant implications for India, potentially reshaping trade dynamics. As New Delhi navigates this change, the global trade landscape could see a shift in power.