I’m a passionate writer who loves exploring ideas, sharing stories, and connecting with readers through meaningful content.I’m dedicated to sharing insights and stories that make readers think, feel, and discover something new.

The U.S. central bank, the Federal Reserve (Fed), announced on September 16, 2025, at the conclusion of its two-day policy meeting that it would keep its benchmark interest rate—the repo rate or federal funds rate—unchanged at 5.25%–5.50%. The Fed’s rate-setting committee, the Federal Open Market Committee (FOMC), stated that the move was designed to balance current economic conditions.

According to the Fed’s statement, the Consumer Price Index (CPI) remained stable at an annualized rate of 3.4% over the past six months, while core inflation (excluding food and energy) held at 3.6%. The unemployment rate hovered around 4.1%, and job creation data remained robust. However, economic growth was moderate, and consumer spending showed signs of slowing. These factors convinced the Fed to maintain its existing rate stance.

Global financial markets reacted positively to the announcement. Major U.S. stock indices, including the S&P 500 and Nasdaq Composite, each rose by over 1%. Asian markets, notably India’s BSE Sensex and NSE Nifty 50, also gained around 0.8%. The rupee-dollar exchange rate remained stable at ₹82.10, bolstering foreign investor confidence and preventing a spike in import costs.

Three primary effects of the Fed’s hold were evident:

Borrowing costs: Mortgage, auto loan, and corporate borrowing rates did not spike unexpectedly, providing stability for consumer spending and business investment plans.

Investment signals: Unchanged returns on bank deposits and government bonds prompted investors to shift toward alternative assets such as mutual funds, equities, and corporate bonds.

Inflation-growth balance: The Fed emphasized that it would remain vigilant until inflation approached its 2% target but would also guard against stifling economic growth.

Analysts believe this decision will sustain consumer confidence and business activity in the U.S. in the coming months. However, some warned that a sudden surge in global energy prices or renewed U.S.-China trade tensions could force the Fed to reconsider a tighter policy.

In conclusion, the Fed’s balanced approach signals neither excessive tightening nor undue accommodation. This measured stance provides global investors, borrowers, and policymakers clarity for planning in the current environment, helps stabilize the rupee, and keeps trade costs in check.

Related articles in this category

El Mencho Killed: The Fall of Mexico's Most Powerful Drug Cartel

February 23, 2026

The recent killing of Nemesio Rubén Oseguera Cervantes, known as 'El Mencho', has led to significant upheaval in Mexico as the Jalisco New Generation Cartel faces a power vacuum. This article explores the implications of his death on the drug trade and national security.

Sam Altman vs. Sridhar Vembu: A Clash on AI and Human Energy Consumption

February 22, 2026

In a recent discussion, Sam Altman compared the energy consumption of AI systems to that of humans, prompting a strong rebuttal from Sridhar Vembu. This article explores their contrasting views on energy efficiency and sustainability.

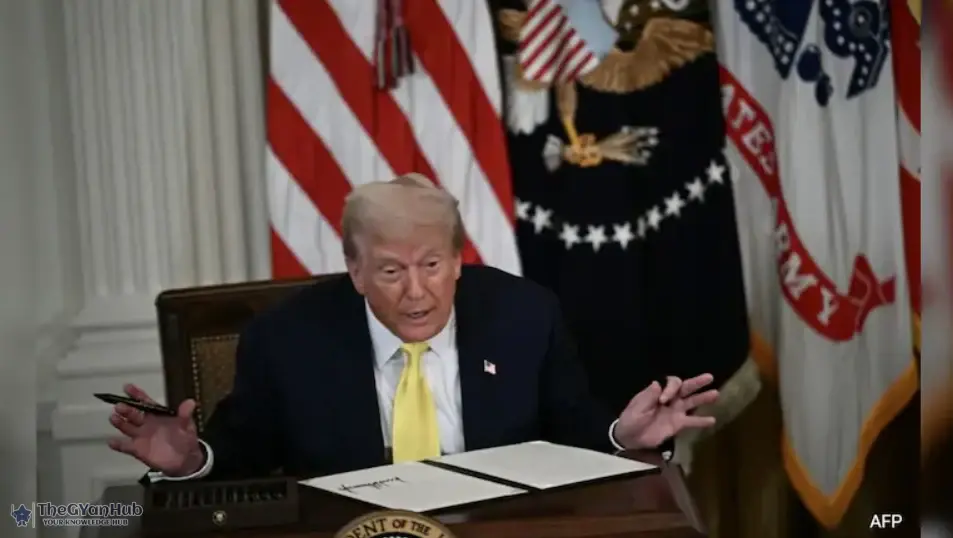

Trump's Loss, India's Gain? How Tariff Order Could Affect Trade Talks

February 20, 2026

The US Supreme Court's decision to strike down Trump's Global Tariffs Policy may have significant implications for India, potentially reshaping trade dynamics. As New Delhi navigates this change, the global trade landscape could see a shift in power.