I’m a passionate writer who loves exploring ideas, sharing stories, and connecting with readers through meaningful content.I’m dedicated to sharing insights and stories that make readers think, feel, and discover something new.

The Rise of Digital Payments in India

India is witnessing a significant shift in its retail sector, fueled by the rapid adoption of digital payments. According to a recent report by Business Standard, the aspirations of a young, tech-savvy population are driving this transformation. The report highlights how digital payments have become a cornerstone of the retail experience, offering convenience and efficiency to consumers and businesses alike.

Digital payment platforms like UPI, Paytm, and Google Pay have seen exponential growth, with more people opting for cashless transactions. This shift is not only limited to urban areas but is also making inroads into rural regions, where digital literacy is on the rise.

The Impact on Retail Businesses

Retailers across India are adapting to this change by integrating digital payment solutions into their operations. This transition is helping businesses streamline their processes, reduce transaction times, and enhance customer satisfaction. Moreover, the availability of data analytics through these platforms allows retailers to better understand consumer behavior and tailor their offerings accordingly.

Small and medium enterprises (SMEs) are particularly benefiting from this trend. By adopting digital payments, they can compete more effectively with larger corporations, offering similar levels of convenience and speed to their customers.

Challenges and Opportunities

While the rise of digital payments presents numerous opportunities, it also poses challenges. Security concerns and the need for robust digital infrastructure are critical issues that need to be addressed. However, the Indian government is actively working to enhance cybersecurity measures and expand internet connectivity across the country.

Furthermore, the digital payments ecosystem is fostering innovation, with startups developing new solutions to cater to the evolving needs of consumers and businesses. This innovation is expected to drive further growth in the sector, making India a global leader in digital payments.

Conclusion

The aspirations of India's population are reshaping the retail landscape, with digital payments playing a pivotal role. As the country continues to embrace technology, the future of retail looks promising, with endless possibilities for growth and innovation.

Further Reading

Related articles in this category

World News

El Mencho Killed: The Fall of Mexico's Most Powerful Drug Cartel

February 23, 2026

The recent killing of Nemesio Rubén Oseguera Cervantes, known as 'El Mencho', has led to significant upheaval in Mexico as the Jalisco New Generation Cartel faces a power vacuum. This article explores the implications of his death on the drug trade and national security.

World News

Sam Altman vs. Sridhar Vembu: A Clash on AI and Human Energy Consumption

February 22, 2026

In a recent discussion, Sam Altman compared the energy consumption of AI systems to that of humans, prompting a strong rebuttal from Sridhar Vembu. This article explores their contrasting views on energy efficiency and sustainability.

World News

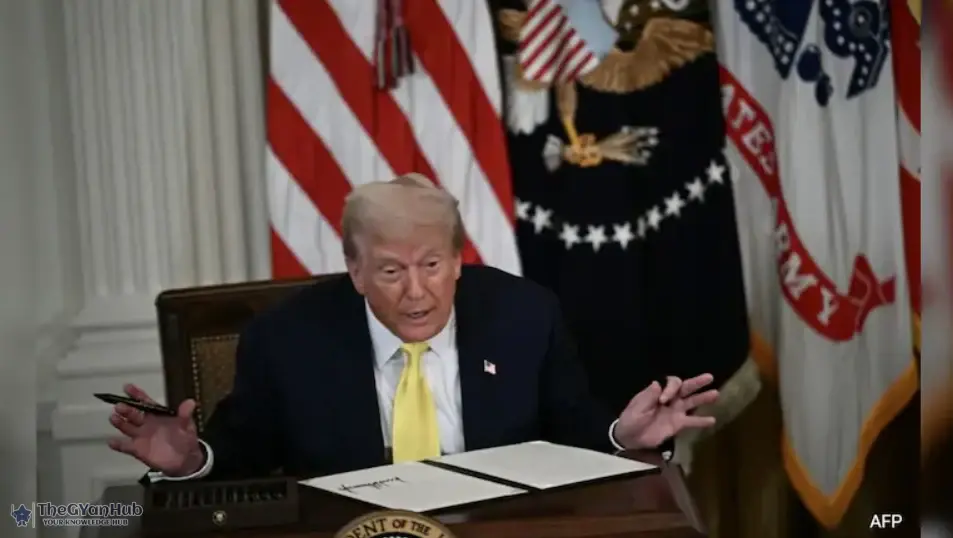

Trump's Loss, India's Gain? How Tariff Order Could Affect Trade Talks

February 20, 2026

The US Supreme Court's decision to strike down Trump's Global Tariffs Policy may have significant implications for India, potentially reshaping trade dynamics. As New Delhi navigates this change, the global trade landscape could see a shift in power.

digital paymentsIndia retailtechnologyUPIcashless transactionsSMEscybersecurityinnovationdigital infrastructure